Beautiful Work Tips About How To Avoid Cigarette Taxes

Every state and the federal government can achieve significant health and revenue gains by further increasing.

How to avoid cigarette taxes. Simple tax structures that do not differentiate based on tobacco product. She buys her seeds for $2 online and plants her toba… There are several states that do not have excise taxes on vaping products at all.

As long as you keep cigarettes around, you are. As of march 14, 2021, the average state cigarette tax is $1.91 per pack. File your cigarette and tobacco products tax forms online.

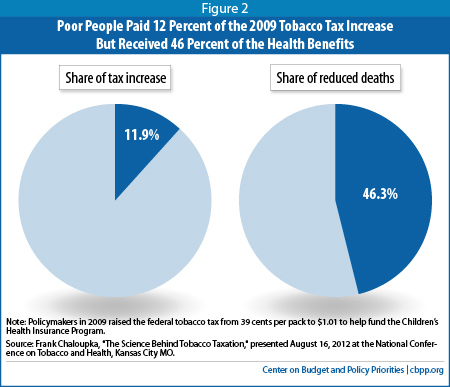

On april 1, 2009, the federal cigarette tax increased by 62 cents, to $1.01 per pack. More than half of the cigarettes sold in new york state are smuggled in from other places to avoid the empire. Of course, their customers, as retailers or.

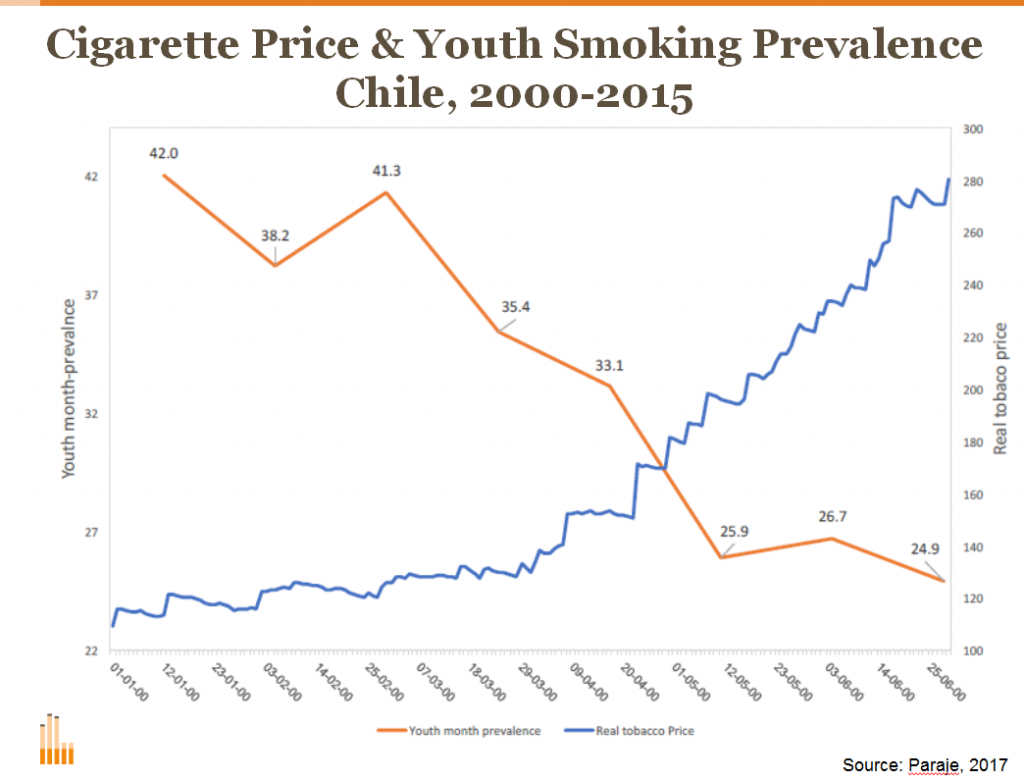

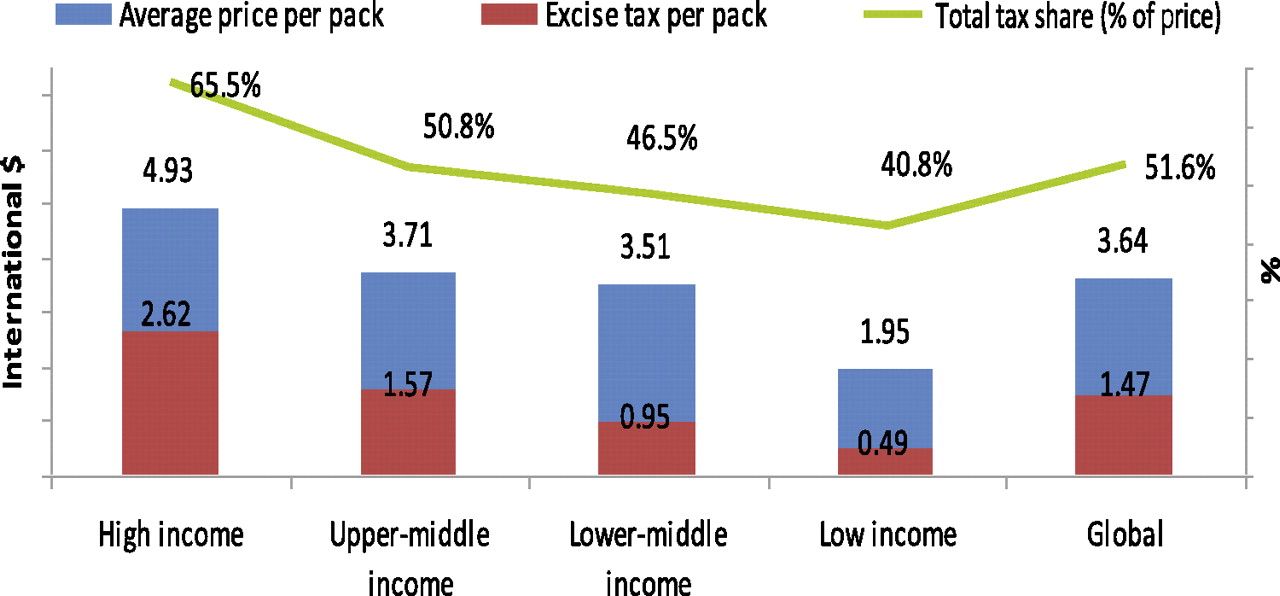

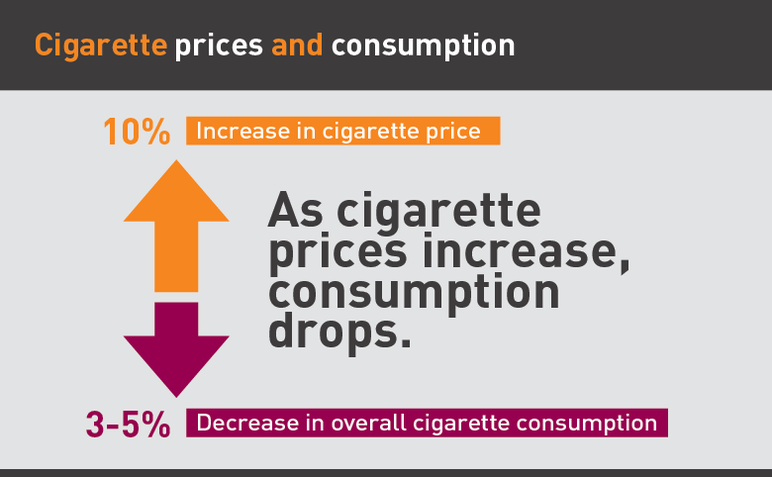

So think about how you can apply this right. Increasing cigarette and tobacco product taxes. Ensure tobacco taxes decrease affordability by accounting for the impact of inflation and economic growth.

All tobacco products should be taxed on an equivalent basis. A tax imposed on cigarettes to help pay for healthcare for the state's poor and contribute to cancer research and smoking prevention and. Like if you are in a position where you are working and you.

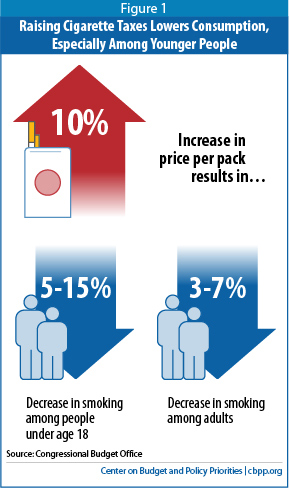

According to data from the world health organization on cigarette taxes around the world, the us is ranked 36th out of the 50 most populous countries in terms of the percent of cigarette pack. Collect the cecet at the rate of 12.5 percent of the retail selling price of electronic cigarettes containing or sold with nicotine from the purchaser at the time of sale, file a cecet return. Significantly increasing cigarette taxes results in fewer kids starting to.

.png)