Exemplary Info About How To Build Credit When Your Young

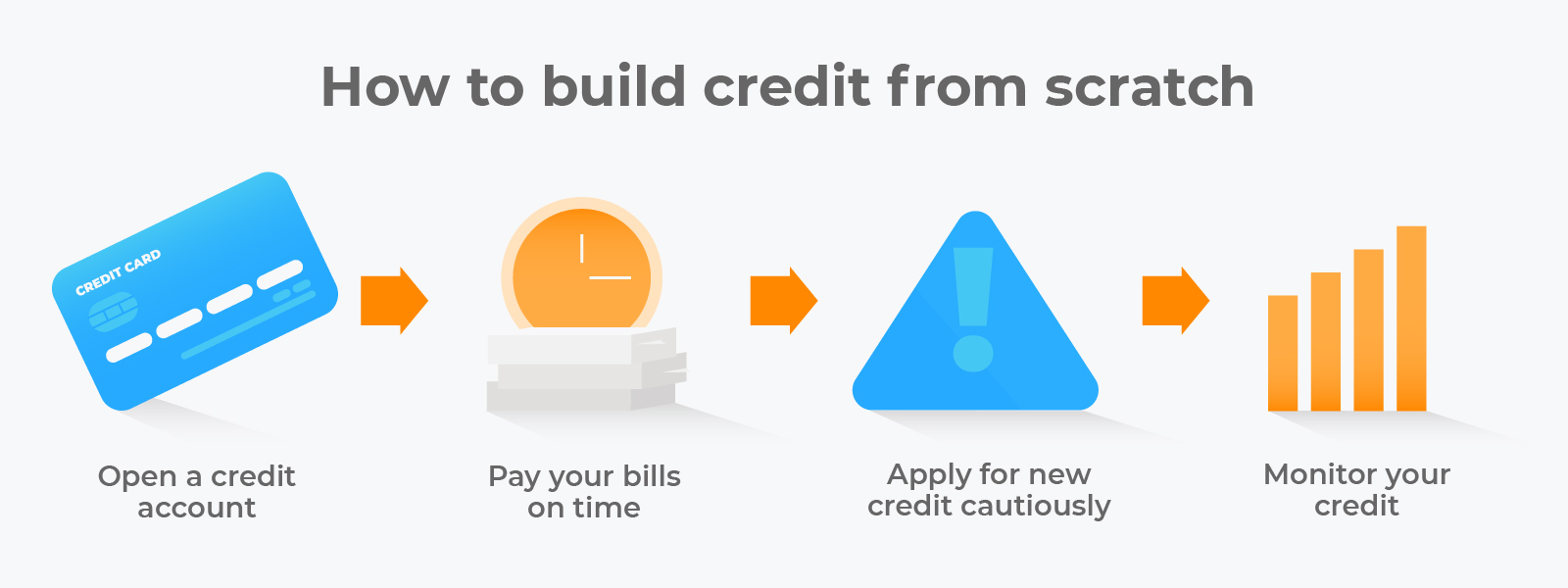

If you've never had credit before, the credit bureaus may have little or no information on.

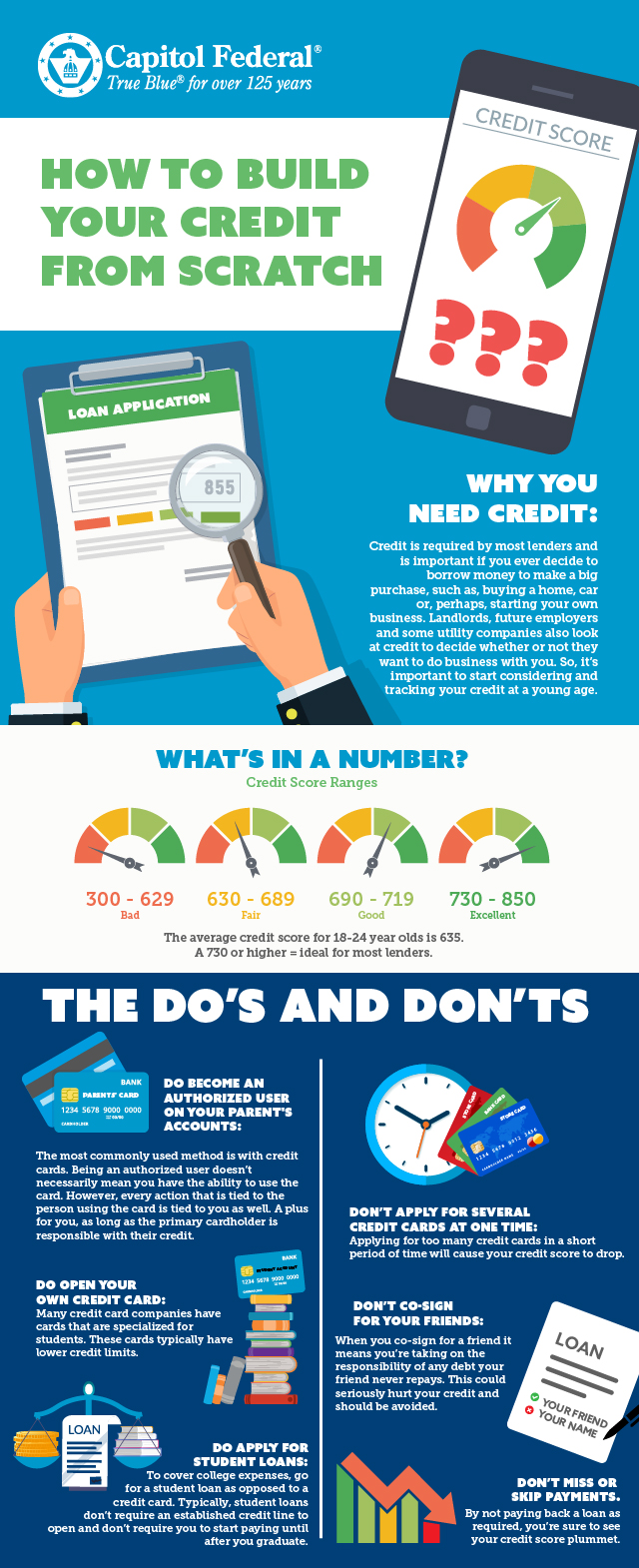

How to build credit when your young. Find a card with features you want. Another common way to begin building credit is to become an authorized user on a parent’s credit card. Your credit score can affect a lot more than just your interest rates or credit limits.

Checking your rate won't hurt your credit score. Get more control over your financial life. Using a credit card ultimately helps you build a credit history, but this relies on you making your payments back on time.

Your credit history can have an impact on your eligibility for rental leases, raise (or lower) your auto. Add your young adult to your credit card account as an authorized user. Your credit score can affect a lot more than just your interest rates or credit limits.

Ad responsible card use may help you build up fair or average credit. Ad build positive payment history with self. Another way that a young adult can build up credit is through what is known as a “credit builder” loan.

Establish good financial behaviors 4. Ultimately, the credit card account isn’t yours, so your parents would be. Find a card offer now.

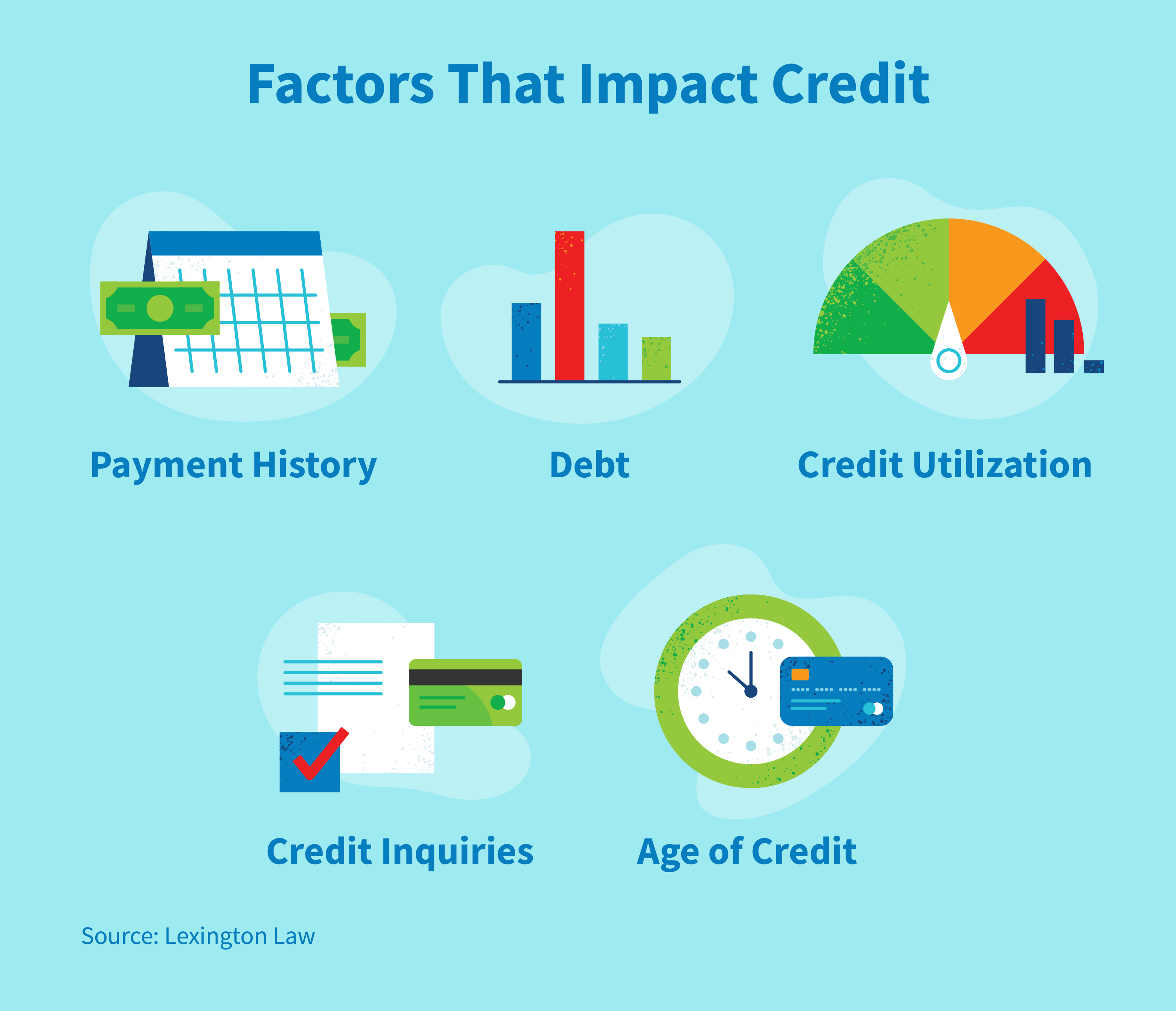

Here’s what you can do: 10 ways young people can build a strong credit record 1. You can build credit at a young age by limiting the amount of debt you take on, adding positive payment history to your credit file and monitoring credit regularly.