Looking Good Info About How To Appeal Property Taxes In Illinois

An appeal can only be filed during certain timeframes.

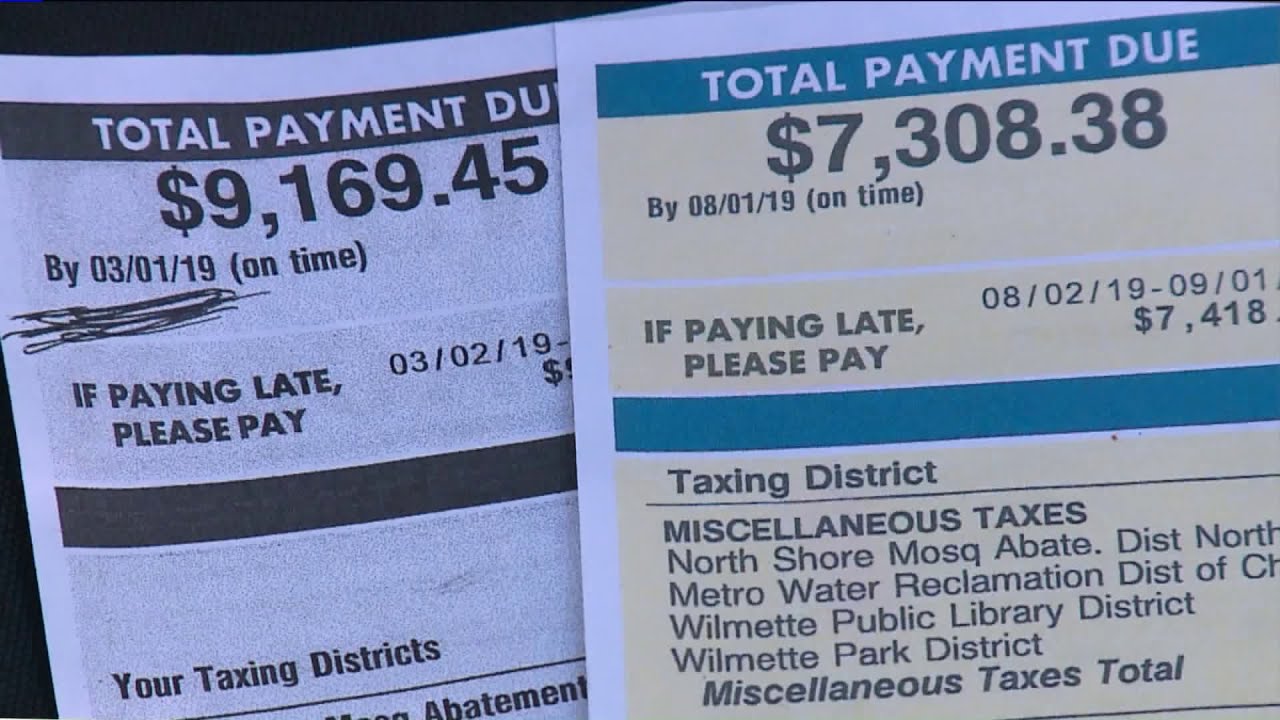

How to appeal property taxes in illinois. You can get your property taxes lowered by proving that your house is worth less than the assessor says it is. Here’s how to appeal your property tax bill, step by step: You must file a formal appeal with your.

If you live in cook county, the official is the county assessor. A formal appeal is made in writing to your county board of review. When you receive your property tax assessment, you only have a limited window to file a property tax appeal, usually within 30 to 60 days.

Property owners can appeal their assessment on their own through the lake county board of review. Plus, since there are several ways your appeal can get thrown out (and lots of heady math involved), a tax attorney can help you figure out whether you have a case—and help. Contact the board for deadlines, complaint forms, evidence you’ll need, etc.

You may find the ptab hearing schedule by following this link: How to appeal property taxes in illinois with donotpay. Appealing an assessment could become difficult,.

In this episode, we explain the process of appealing property taxes in illinois. Access donotpay from a web browser. An appeal based on a.

Must be completed in its. Provide necessary info about you and your property. Decide if a property tax appeal.

.png)