Fun Info About How To Buy Second Property

On a happier note, you may pay less council tax.

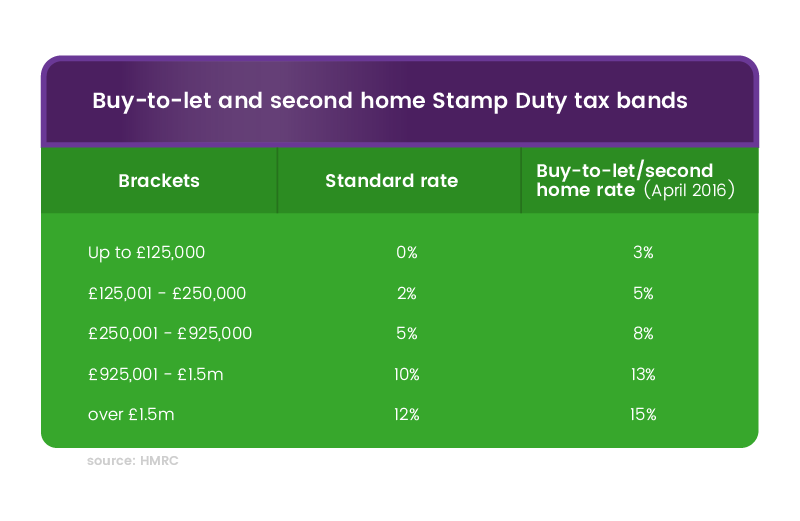

How to buy second property. Ad compare 2022's best 2nd mortgage lenders. You typically need a 25% deposit for a second property. Use your home equity & increase your home value.

Lenders are worried about the increased risk of. With the average property price in the uk sitting at. The minimum cash down payment.

This will be measured against the. For your second property, you will need to pay up to 25% of your property’s down payment in cash. Let us help you buy a second property.

You cannot buy another property within 5 years due to the minimum occupation period (mop). This can be pretty pricey, as the average cost to. Whether you’re investing in a rental property or a vacation home as a second property, we can help you make the most of your purchase.

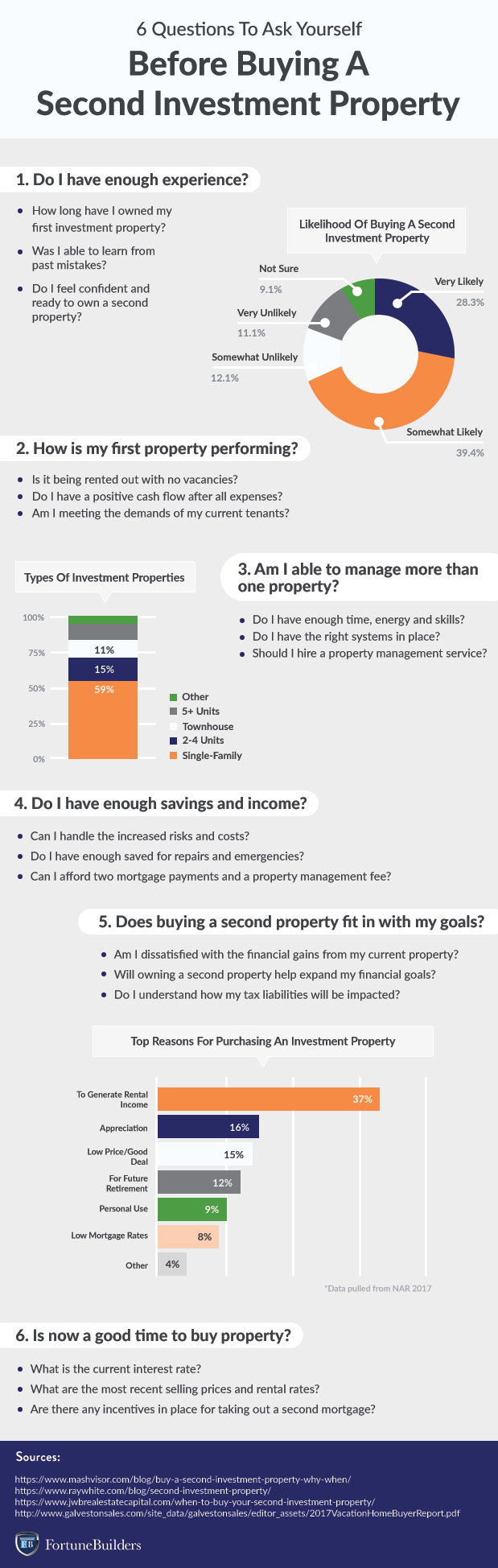

Other sources for finding money for a. Lock rates before next rate hike. One popular reason for buying a secondary property is to profit from a strong housing market.

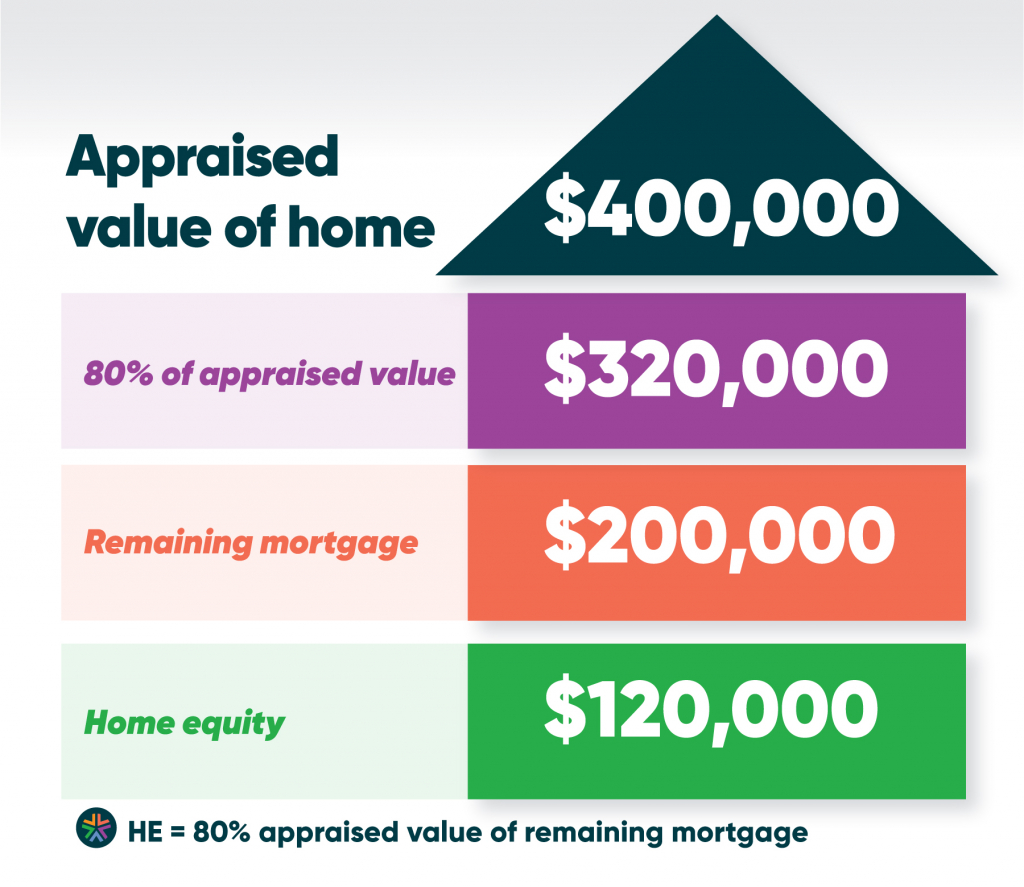

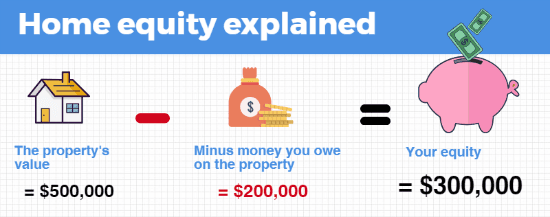

How to buy your second property your eligibility. If you’re considering buying a second investment property, you should factor in the cost of making a higher down payment. A home equity loan or home equity line of credit (heloc) is a loan used to pull equity out of a first home to fund the down payment of a second home.

/GettyImages-1081824440-2fcd29d1f0974847af9b6f57a3d2ba6d.jpg)