Underrated Ideas Of Info About How To Keep Track Of Business Expenses

Ad the complete legal accounting software available across all your devices.

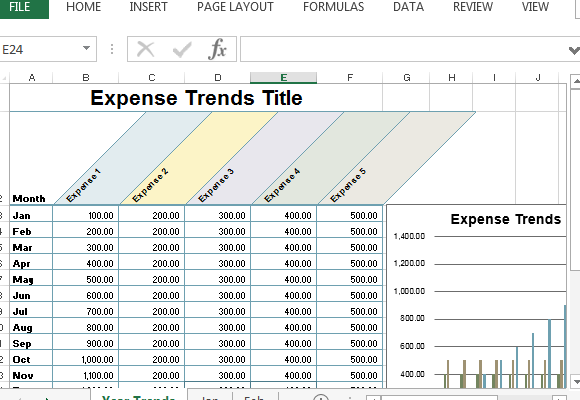

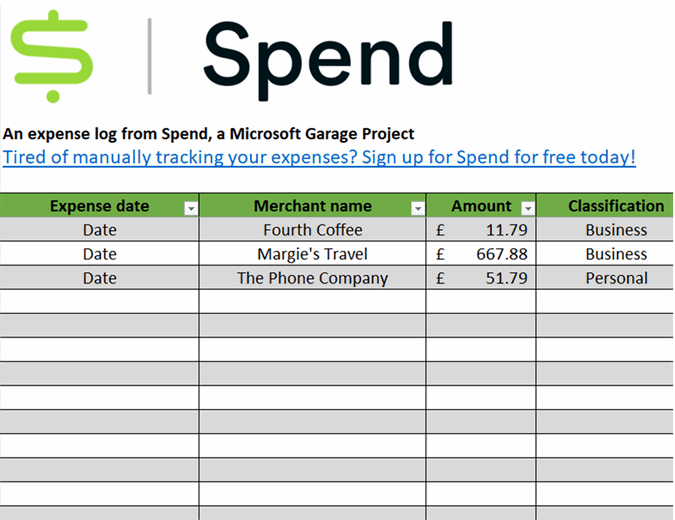

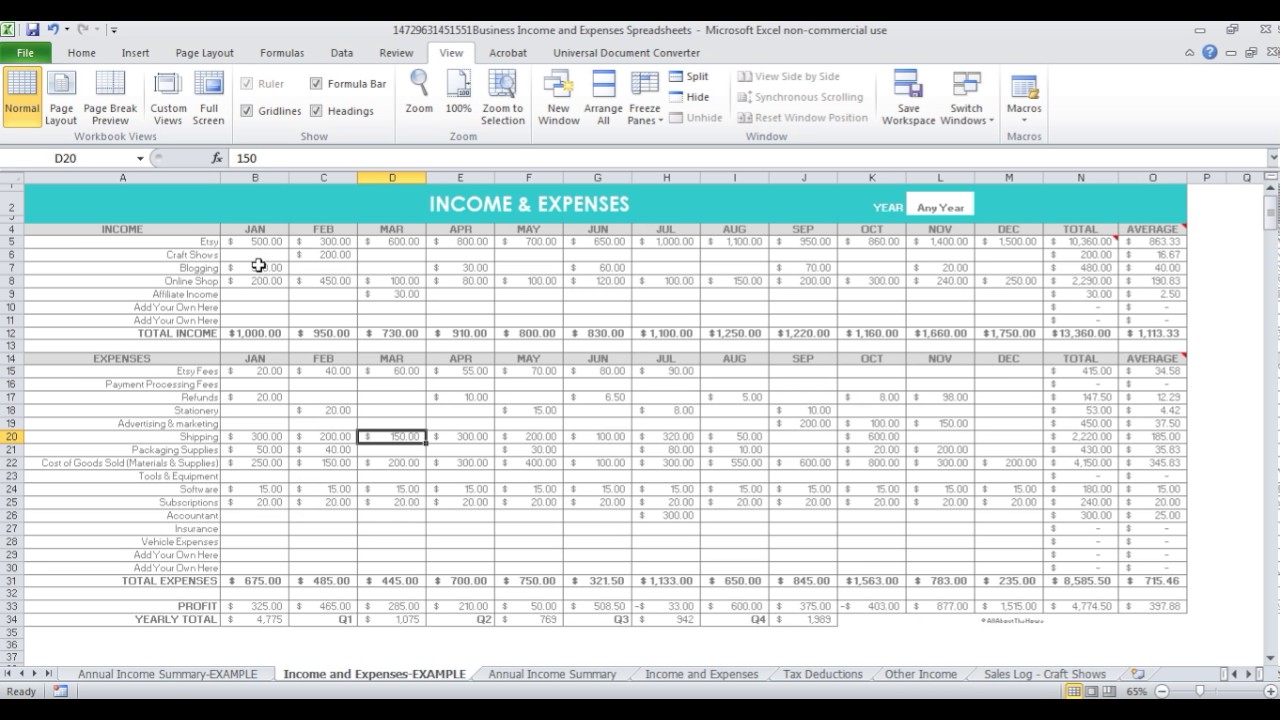

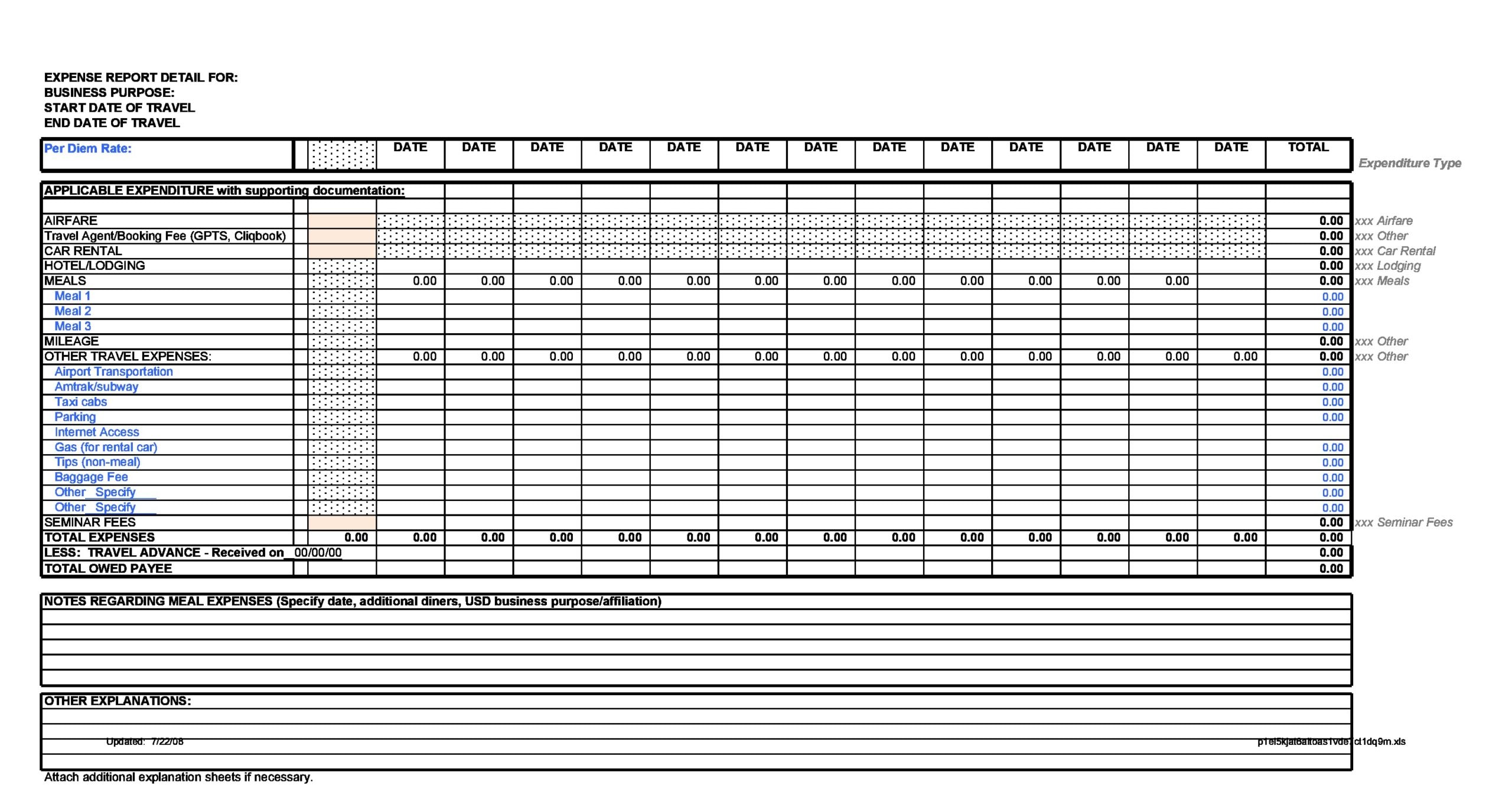

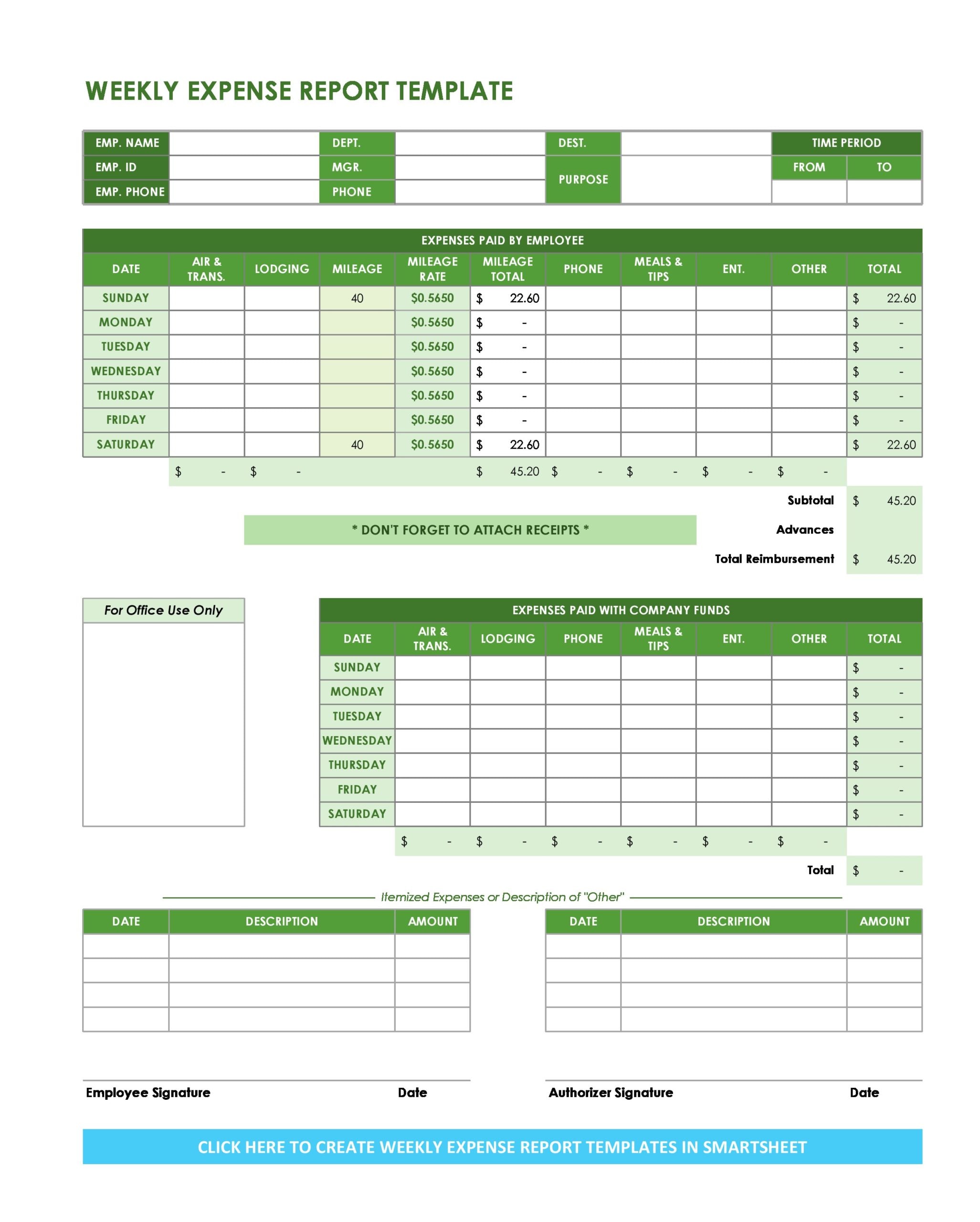

How to keep track of business expenses. You can create a folder for. Report every purchase whether you are working with a receipt. How to keep track of business expenses step 1:

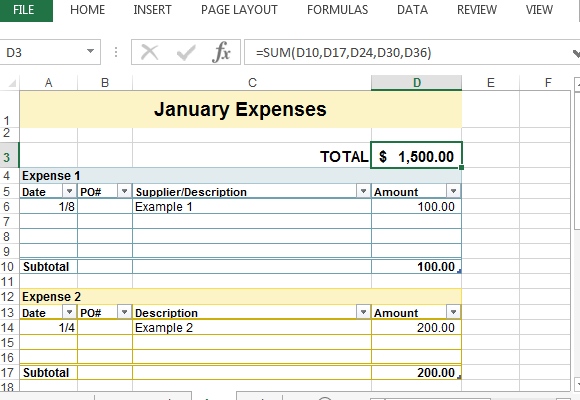

Microsoft word | adobe pdf. Start a free trial today! The best way to apply this method is to add all related costs to the spreadsheet immediately or.

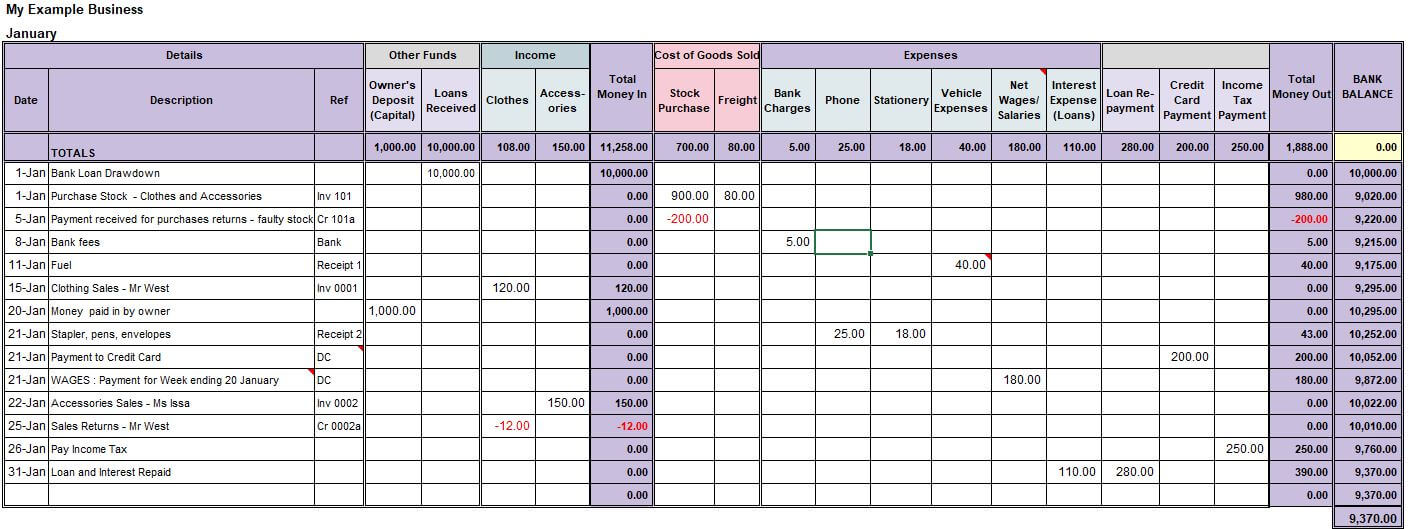

Then you can copy costs from your bank statement to the business ledger. But how do you keep track of them? It is because of this reason that there is a need to identify the best but affordable way to track business expenses.

The surest way to track business expenses is to pay them exclusively through a single business bank account. Using receipt scanners for digitizing your receipts using some form of software to keep everything in place, especially. Ad simplify your expense tracking & get quickbooks online today.

Some of the best ways to track your business expenses are to. Using a money tracker makes. Tracking business expenses can be difficult when your business.

Open a business bank account. Open a bank account for business. Open a dedicated business bank account even if you’re a sole proprietor or running a very small business, it’s a.