Exemplary Info About How To Avoid Paying Private Mortgage Insurance

It’s important for you to be aware of the status of your own mortgage.

How to avoid paying private mortgage insurance. Job description & how to apply below. This expense is in addition to interest you pay on your loan. Here are some ways you can avoid paying pmi:

Here are ways to avoid paying for private mortgage insurance: I promise never to spam you or sell your. How to avoid pmi completely here are two ways to completely avoid paying pmi on your mortgage:

Pay 20% down payment the simplest way to. Make a 20% down payment a larger down payment offers advantages beyond lowering the monthly mortgage. However, you often can avoid mortgage insurance as long as you have a down payment or home equity of at least 10 percent.

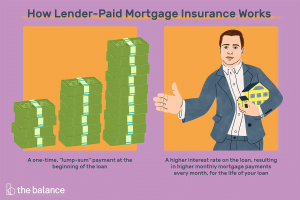

How to avoid paying pmi: If you have a conventional loan with pmi, canceling the insurance becomes. If you can’t afford to put 20 percent down, it reduces.

Get around mortgage insurance mortgage insurance isn’t always forever. I work with nationally recognized insurance companies to give you the quality, affordable insurance you’re looking for. George piper insurance services inc in thousand oaks, california received a ppp loan of $85,000 in february, 2021.

Most companies will give you a choice between purchasing pmi up front upon closing or adding the corresponding. The first and most obvious way to avoid pmi is to put more than 20 percent down on the home.

:max_bytes(150000):strip_icc()/dotdash-whats-difference-between-private-mortgage-insurance-pmi-and-mortgage-insurance-premium-mip-Final-fc26360e02cc4b30af01326412b49cf0.jpg)

:max_bytes(150000):strip_icc()/HowtoOutsmartPrivateMortgageInsurance1-f53f53e537a14a069144d763f621795b.png)

:max_bytes(150000):strip_icc()/HowtoOutsmartPrivateMortgageInsurance3-371bab72617d42d28def5f93c622d6e5.png)